A New Chapter in Indian Taxation

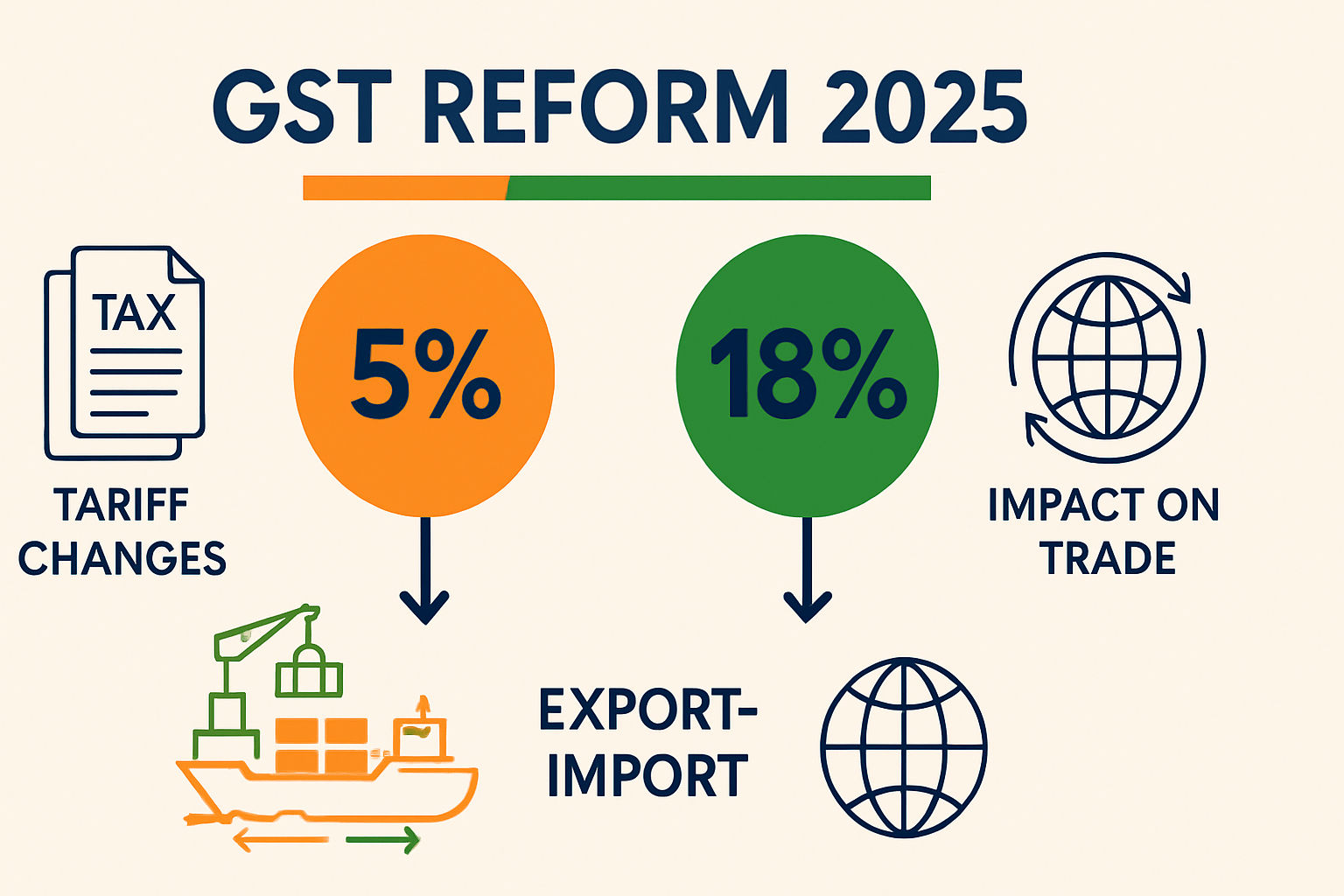

India’s indirect tax landscape has undergone a monumental shift in 2025. On September 3, the GST Council announced a comprehensive overhaul dubbed GST 2.0, replacing the cascading labyrinth of four major GST rates with a much-simplified two-slab system: 5% and 18%. These new rates—effective from September 22, 2025—herald India’s most significant indirect tax reform since GST’s original nationwide rollout in 2017.

What Are the New GST Slabs?

- 5% GST: Covers essential food items, medicines, and basic consumer goods such as soaps, toothpaste, and Indian breads.

- 18% GST: Applies to a broad range of goods including electronics, consumer durables, professional services, textiles, and small cars.

- 40% GST (Special Slab): Imposed on super luxury, sin, and demerit goods—premium cars, alcohol, tobacco, and casino services.

Nearly 90% of items previously taxed at the steep 28% rate now move to 18%, while almost all 12% items shift down to 5%. This reallocation addresses longstanding complaints about the old system’s complexity and inverted duty structure, providing relief to both manufacturers and traders.

Simplification and Benefits to Trade

- Ease of Compliance: Businesses—especially SMEs and exporters—will benefit from reduced paperwork, fewer rate disputes, and a faster refund process. Exporters should see improved working capital management via streamlined GST credits and prompt refunds.

- Boost to Competitiveness: Lower rates on inputs mean production costs fall for many sectors, improving India’s export price competitiveness globally.

- Stimulus for Consumption: By reducing GST on essentials and widely consumed goods, the reform is expected to stimulate domestic demand, aiding growth across consumer-focused industries.

Tariff Headwinds: US Rate Hikes

While GST 2.0 offers domestic relief, India’s global trade faces new headwinds. In August 2025, the US government imposed steep new tariffs—up to 50%—on a broad basket of Indian goods, targeting key export sectors like textiles, gems, jewelry, auto components, and chemicals.

- Export Risks: With 55% of Indian exports to the US now at risk, many exporters have reported demand shocks, order cancellations, and pressure for heavy discounts from American buyers.

- Economic Impact: Analysts predict GDP losses of 0.3-0.5% and decreased rupee stability. However, pharmaceutical and critical mineral exports are spared due to supply chain dependencies in the US.

- Diversification Drive: The government is urging businesses to explore new markets and supply chains, while ramping up support for MSMEs.

Navigating the Future: Strategies for Traders

- Leverage GST Simplification: Take advantage of simpler compliance, faster refunds, and cost savings to remain globally competitive.

- Focus on Value Addition: With higher tariffs in the US, Indian exporters must focus on high-value products, branding, and quality to justify price jumps.

- Market Diversification: Explore trade relationships beyond the US, targeting markets in the EU, Middle East, and Asia-Pacific to cushion export shocks.

Conclusion

India’s GST 2.0 heralds a transformative phase—simpler taxes, boosted compliance, and lower costs for most businesses. However, escalating US tariffs introduce fresh challenges for exporters and call for agile adaptation. The key for Indian traders: leverage the domestic advantage of GST reform while embracing global diversification for sustained success in a volatile world trade environment.