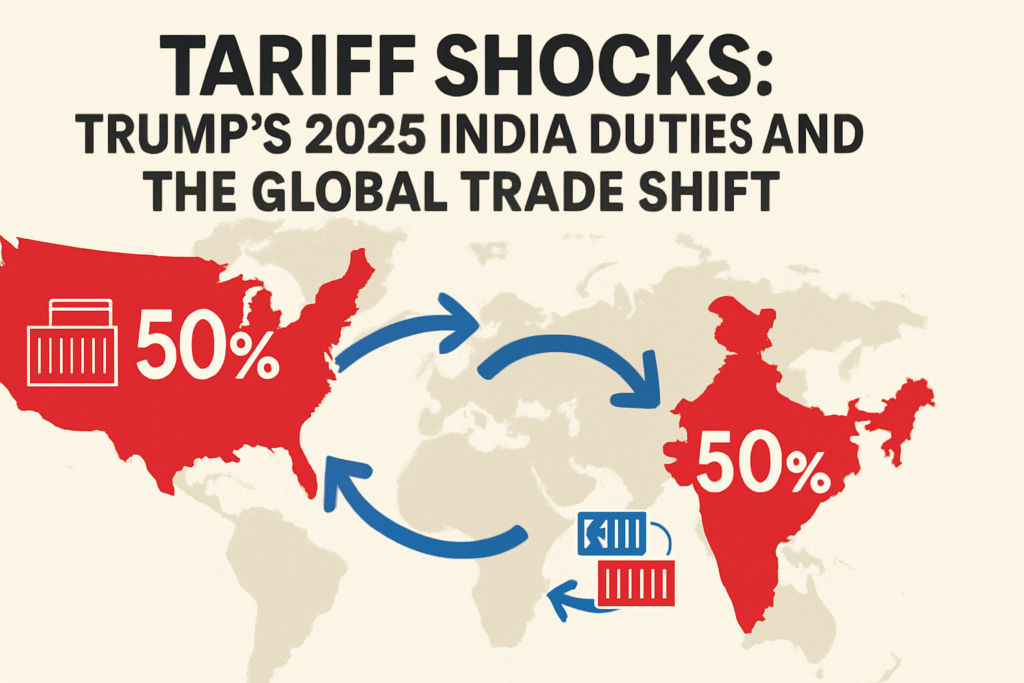

World trade in 2025 is witnessing significant upheaval due to rising tariff tensions, punctuated by President Trump’s imposition of 50% duties on Indian imports and accelerating global import barriers. These moves are reshaping supply chains, trade relationships, and the economic outlook for countries worldwide.

The Story Behind Trump’s 50% Tariffs

The US administration, led by President Trump, has dramatically escalated tariffs on imports from India, including a 25% punitive measure due to India’s purchase of Russian oil, resulting in total duties as high as 50% on products like apparel, jewelry, chemicals, solar panels, and more. Trump argues these tariffs retaliate against India’s “one-sided” trade practices and its high barriers to American exports. India’s exports—especially to the US, its biggest market—now face skyrocketing costs, threatening thousands of jobs, particularly in states like Gujarat.

Global Import Barriers and Escalating Protectionism

It’s not just India under pressure. The US has raised duties on steel, aluminum, and automotive imports from allies such as Canada, Mexico, and the EU, lifting its average tariff rate to 13.8% in 2025—the highest level since 1939. China, bracing for U.S. trade warfare, is preparing countermeasures including restrictions on U.S. food products, while Europe responds with duties targeting subsidized Chinese imports. This tit-for-tat escalation signals a global retreat from free trade toward protectionism, complicating long-standing international supply chains and business strategies.

Economic and Geopolitical Impacts

The ramifications are severe:

- India’s economy may lose up to 0.8% of GDP due to lost exports and decreased competitiveness.

- High tariffs disrupt global supply chains, slow trade, raise costs for consumers and producers, and risk inflation in both the U.S. and partner nations.

- Some emerging countries see opportunity as supply chains shift, though most face significant disadvantages competing with China’s manufacturing base.

- The fragmentation of global financial systems due to parallel currency initiatives and trade blocs (i.e., BRICS new currency) further destabilizes trade and investment.

Outlook for World Trade

The dramatic tariff increases have shocked the rules-based international trading system, creating deep uncertainty for businesses and governments. While some countries hold firm to WTO principles and pursue new alliances, the US position signals a move to national security-driven trade policy. Long-term, the world may see even more fragmented trade, with shifting alliances and ongoing disputes over access, standards, and supply chain dependencies.

Ultimately, rising tariff tensions—exemplified by Trump’s 50% duties on India—are reshaping global trade by forging new economic alliances, redrawing supply chains, and challenging the foundations of globalization, with significant consequences for growth, jobs, and development across continents.

conclusion

The escalating tariff tensions of 2025—marked by President Trump’s 50% duties on Indian imports and widespread global import barriers—have created an environment of uncertainty and challenge for international trade. While these moves threaten export-driven sectors and complicate key trade relationships, major economies like India are demonstrating resilience through bold domestic reforms, stronger consumption, and proactive market diversification. As supply chains are redrawn and new alliances forged, the global economic landscape is evolving, signaling a shift toward protectionism but also providing opportunities for long-term competitiveness and strategic adaptation. The world now stands at a crossroads—where innovation, collaboration, and internal strength will determine who thrives amid rising barriers and shifting trade currents.